Arthway

Arthway – the Pathfinder identifies category-leading startup companies and partners with them in ramping up the pace...

Fitbit, Inc. (FIT) shares moved on volatility today +0.84% or +0.52 USD at the close. The Nasdaq-listed company saw a range $ 61.55 – 62.55 Vol 111.5K Mkt cap USD 1.85B.

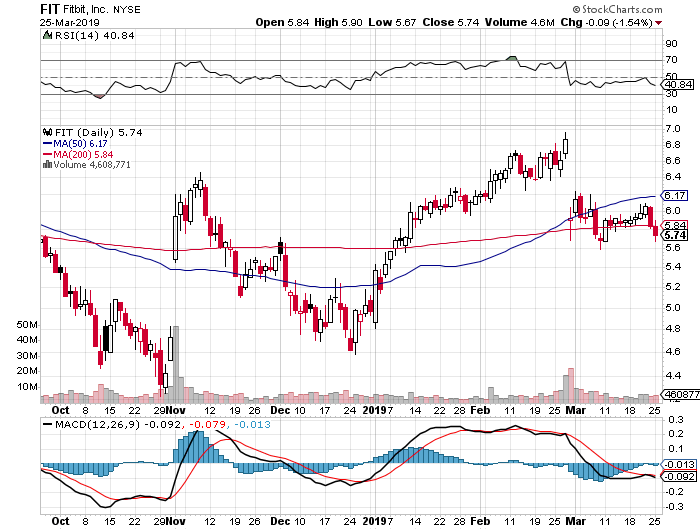

Fitbit, Inc. (FIT)’s technical levels – we can see that the MACD (12,26,9) sits at 0.355, 0.456, -0.101, EMA (30) 42.02 and RSI (14) 52.43. The Moving Average Convergence/Divergence oscillator (MACD) is one of the simplest and most effective momentum indicators. MACD was developed by Gerald Appel in the late seventies. The MACD turns two trend-following indicators, moving averages, into a momentum oscillator by subtracting the longer moving average from the shorter moving average. As a result, the MACD offers the best of both worlds: trend following and momentum. The MACD fluctuates above and below the zero line as the moving averages converge, cross and diverge. Traders can look for signal line crossovers, centerline crossovers and divergences to generate signals. Because the MACD is unbounded, it is not particularly useful for identifying overbought and oversold levels.

Fitbit, Inc. (FIT) currently has Full STO %K(14,3) %D(3) 51.92, 52.98. Active investors may choose to use this momentum indicator as a tool to anticipate a future reversal.

Developed by George C. Lane in the late 1950s, the Stochastic Oscillator is a momentum indicator that shows the location of the close relative to the high-low range over a set number of periods. According to an interview with Lane, the Stochastic Oscillator “doesn’t follow price, it doesn’t follow volume or anything like that. It follows the speed or the momentum of price. As a rule, the momentum changes direction before price.” As such, bullish and bearish divergences in the Stochastic Oscillator can be used to foreshadow reversals. This was the first and most important signal that Lane identified. Lane also used this oscillator to identify bull and bear set-ups to anticipate a future reversal. Because the Stochastic Oscillator is range bound, is also useful for identifying overbought and oversold levels.

The RSI, or Relative Strength Index, is a widely used technical momentum indicator that compares price movement over time. FIT’s 14-day RSI is currently at 52.43. The RSI may be useful for spotting abnormal price activity and volatility. The RSI oscillates on a scale from 0 to 100. The normal reading of a stock will fall in the range of 30 to 70. A reading over 70 would indicate that the stock is overbought and possibly overvalued. A reading under 30 may indicate that the stock is oversold, and possibly undervalued. The relative strength index (RSI) was developed by J. Welles Wilder and published in a 1978 book, New Concepts in Technical Trading Systems, and in Commodities magazine (now Futures magazine) in the June 1978 issue. It has become one of the most popular oscillator indices. The RSI provides signals that tell investors to buy when the stock is oversold and to sell when it is overbought.

Today, the resistance, pivot, and support points for Fitbit, Inc. (FIT) are R2 43.04, R1 42.46, P 40.97, S1 40.15, S2 38.90. Pivot Points are significant levels chartists can use to determine directional movement, support, and resistance. Pivot Points use the prior period’s high, low and close to formulating future support and resistance. In this regard, Pivot Points are predictive or leading indicators. There are at least five different versions of Pivot Points. Pivot Points were originally used by floor traders to set key levels. Floor traders are the original day traders. They deal in a very fast moving environment with a short-term focus. At the beginning of the trading day, floor traders would look at the previous day’s high, low and close to calculate a Pivot Point for the current trading day. With this Pivot Point as the base, further calculations were used to set support 1, support 2, resistance 1 and resistance 2. These levels would then be used to assist their trading throughout the day.

ArthWay (Arth, Inc.)

588 EL CAMINO REAL UNIT 210

SANTA CLARA, CA 95050

USA

Sector: Technology

Industry: Computer Software

No. of Employees: 10-50

Arthway – the Pathfinder identifies category-leading startup companies and partners with them in ramping up the pace...

Palo Alto Networks is the world's leading cybersecurity company, with technologies that protect over 80,000 enterprise...

Marqeta has re-engineered how payment cards, virtual cards and mobile authorization products should be developed and...